Does this story sound familiar?

As attorneys, we’ve all been in this situation before: your heart sinks as you receive an email from your payment processor stating your client’s monthly retainer payment of $400 has been declined, disputed, or—worst of all—charged back, returned, etc. The disputed amount gets taken out of your account immediately and you’re left with no recourse to prove the charge was authorized. Even if you do provide proof, you have to wait up to three months to see that money returned.

These kinds of financial nightmares occur all the time. It doesn’t seem, at first, like they have that large of an impact on your bottom line. But after it happens to you several times in a month, you start to feel panicked. It starts to make an impact on your life, from paying bills to making rent. Is this your new, terrifying status quo? Aren’t lawyers supposed to be financially secure? Chasing payments and going after clients to get paid is not the job you took the bar exam for.

You might resolve many of these issues over time, but as they start stacking up you feel like the nightmare will never end. Dealing with legal lending challenges and going after retainer payments causes a “bad vibes” avalanche that, if left to snowball, can spread and cover all aspects of your life…affecting your staff, the family you go home to, and your caseload of other clients that are paying on time. Everyone has to get paid and you’re carrying the stress of how that happens.

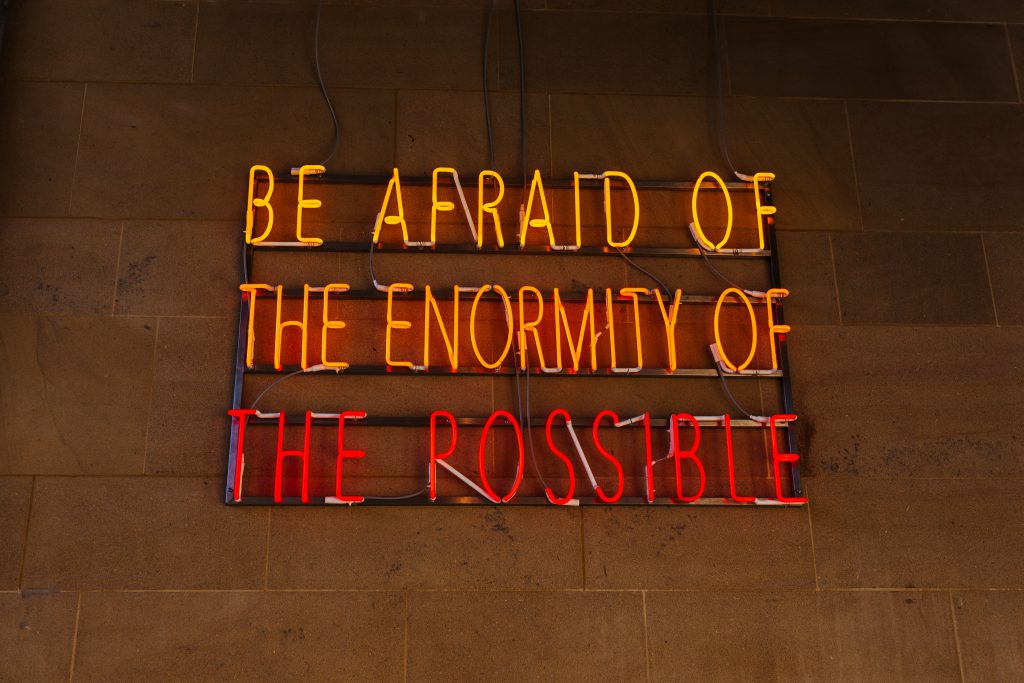

The byproduct of all this instability is that fear and desperation can set in. Fear is why we’ve all made the mistake of trying to milk every client upfront. Losing clients to cost leads to desperation, desperation leads to frustration, and clients can sense it. The avalanche spreads…This happens daily, all across the country, in firms and practices both big and small. Older, established firms deal with it and new, hardworking young lawyers deal with it too. The legal retainer financing problem plagues all. However, the smartest attorneys—the ones who keep searching, learning, and pursuing ways to improve their careers—all seem to land on the same solution for the problem. They’ve found the holy grail of legal payment management. They’ve found iQualify Lending.

iQualify, powered by Fortify, will cure your retainer financing headache once and for all. You’ll be able to get back to doing what you were meant to do…practice law. iQualify provides a legal lending solution that attorneys across America are using daily to sign more clients, make more money, and get rid fo the stress of chasing clients for money. It’s affordable and can start fixing your practice’s financial problems immediately. Our client payment management system builds a structure of financial stability in your practice. It doesn’t happen overnight, but the change iQualify brings to your business frees up time and is the key to moving forward and conquering your law practice without fear!

Achieving financial stability for your law practice with iQualify is a three-step process.

- Step 1: you sign up and get the Fortify software

- Step 2: getting clients signed up, stress melts away

- Step 3: financial stability and YOU practicing law, not collections

Ready to see how it works? Reach out to us right now and see for yourself how iQualify Lending can vanquish your fears, make you more money, and get you on the path to success today.